Gain synthetic exposure to a fund or an index exchanging its yield versus cash or other types of return.

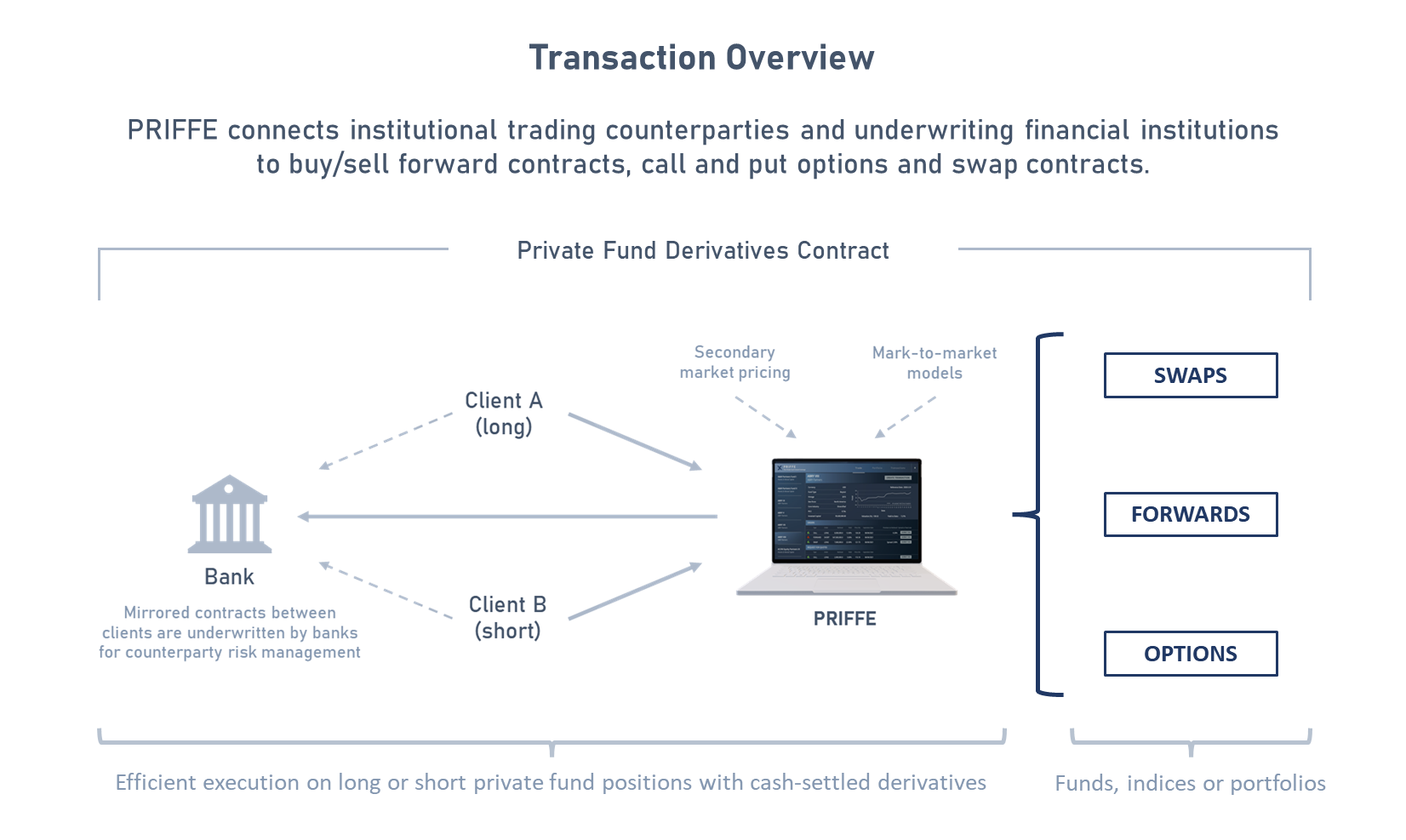

XTAL has built the first private market fund and index derivatives exchange. By trading on PRIFFE, investors can access unprecedented liquidity, portfolio and risk management possibilities. PRIFFE instruments give investors the possibility to actively adjust their private market allocations, in a symmetric or asymmetric way. By leveraging very efficient overlay transactions with the objective of managing risk or locking in returns, investors can respond to the challenges of the macro-economic conditions, without altering the composition of the direct portfolio. Buy or sell a fund or an index at an agreed price with future settlement. Buy or sell the right to transact on a fund or an index at an agreed price.

De-risk a private fund portfolio by hedging a single fund or an index. Monetize by selling 'out of the money' contract. Get more efficient execution on long or short private fund positions with cash-settled derivatives.

Currently, trading private funds implies that two parties agree on the spot value of a NAV (typically referred to a prior quarter-end than the transaction date) adjusted to current market terms, with or without a discount deriving from negotiation, plus the residual obligations on the traded commitment. All this process currently happens in absence of a generalized pricing framework that should otherwise be available to both parties in order to define equitable trading terms. In addition, there is no possibility to utilize term contracts, that could offer better risk management possibilities, because there is no way to set a NAV to be exchanged in the future. Yield derivatives are unique in their ability to split equity and credit risk over a given time horizon, which can be customized. Unlocking a seamless, standardized exchange of private funds’ credit and equity risk, multiplies trading incentives, attracts a broader group of investors (arbitrageurs, hedgers, traders, etc.) and leads to a bigger pool of available liquidity.

Copyright © 2022. All rights reserved.Exploit the Fungibility of Private Fund Yield Derivatives

Trade the Forward Curve.

PRIFFE - THE PRIVATE FUND FORWARD EXCHANGE

Cutting through illiquidity.

RISK TRANSFER: A BROADER NOTION OF LIQUIDITY

ENHANCING PRIVATE MARKETS' FUNCTIONS OF USE

Reiventing institutional investment, liquidity and democratization.

For Limited Partners

For General Partners

For Intermediaries

DISCLAIMER