XTAL proprietary algorithms allow daily apple-to-apple comparability of private and public market perfomance and robust predictability of returns by taking advantage of essential pricing information about risk and volatility. As a result, the duration-based analytics introduced by XTAL represent a complementary, efficient toolkit for forward-looking asset allocation and risk management decisions that transposes private market investments in the real-time, multi-asset framework of all stakeholders, often non-specialists, in the C-suite and at board level. The intelligence of XTAL Analytics is securely accessible on the cloud via the SESTANTE dashboard or via customised projects to meet investors' specific requirements. A cloud based, innovative toolkit that empowers investors without any false illusion of control but with a robust probabilistic valuation framework.Not All Private Equity Analytics Are Born Equal

Time-weighted accruracy for private market yield and beta leads to unprecedented results.

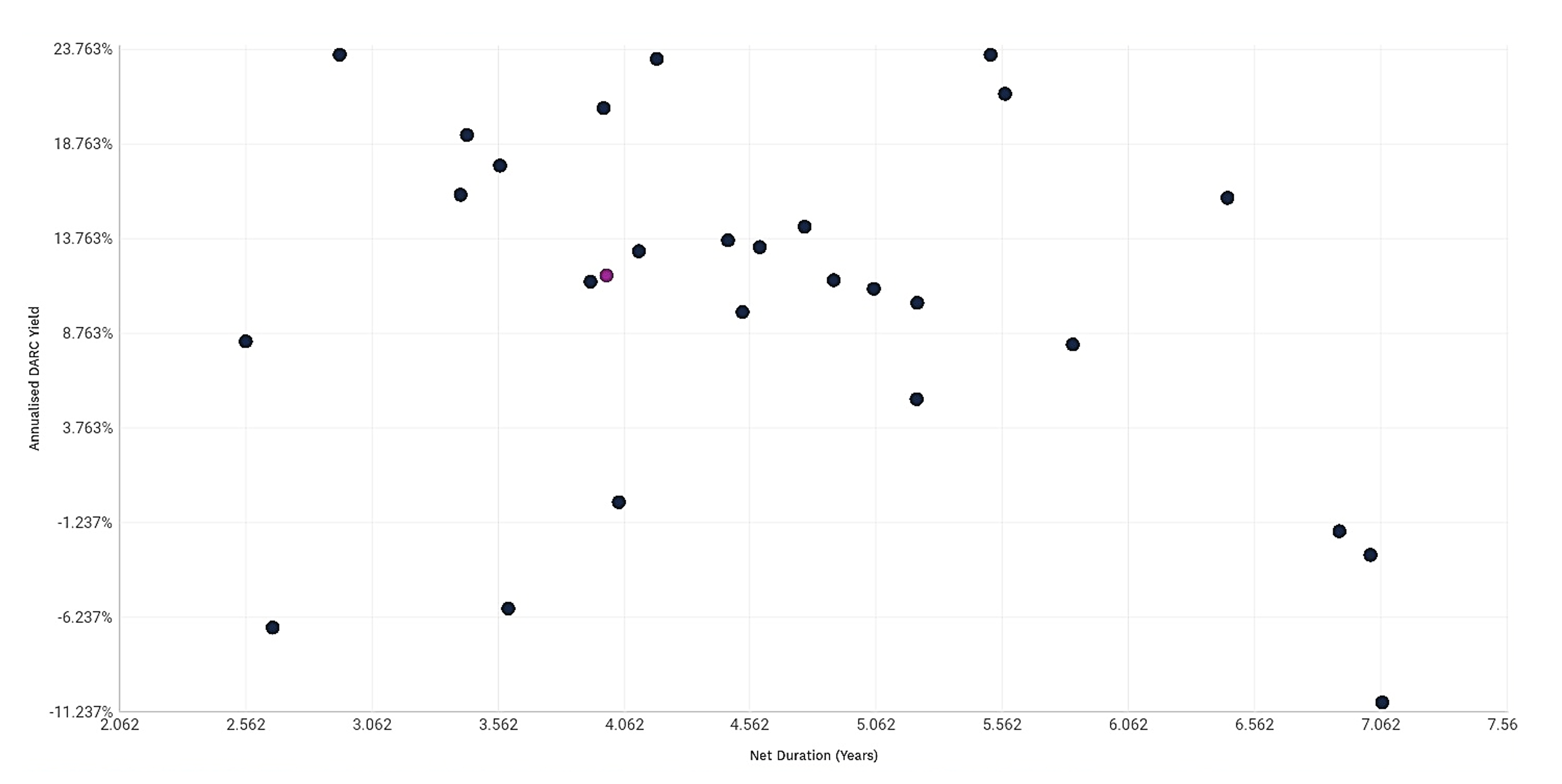

FORWARD PERSPECTIVE

Duration Makes All the Difference

The DARC puts the IRR in a time-weighted context - the forward net duration tells the true value creation story.

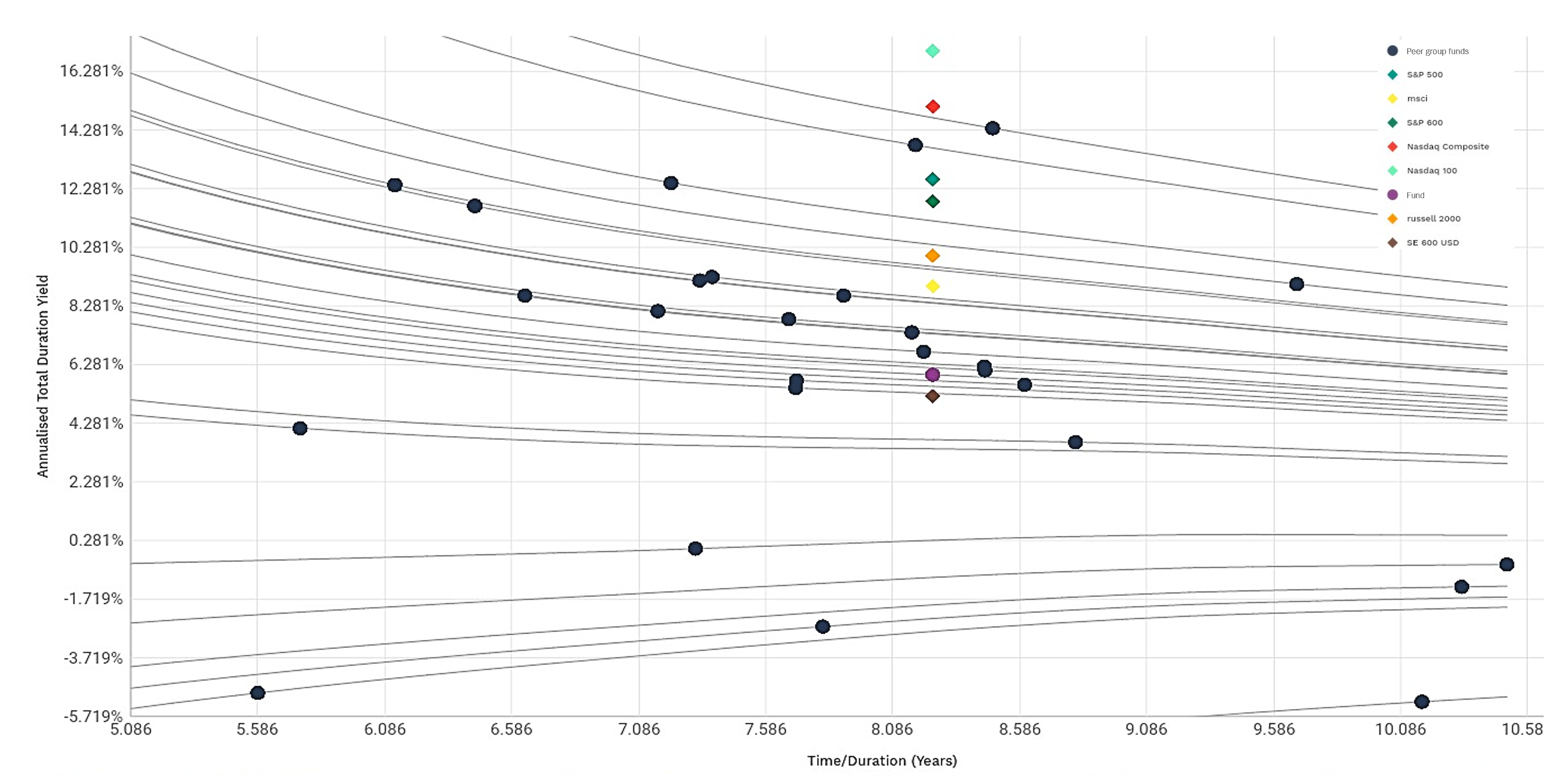

LEVELED MEASURING FIELD

A Lower Return May Not Tell the Full Story

Proper comparability requires iso-duration curves - introducing the toolkit for unambiguous quartiles.

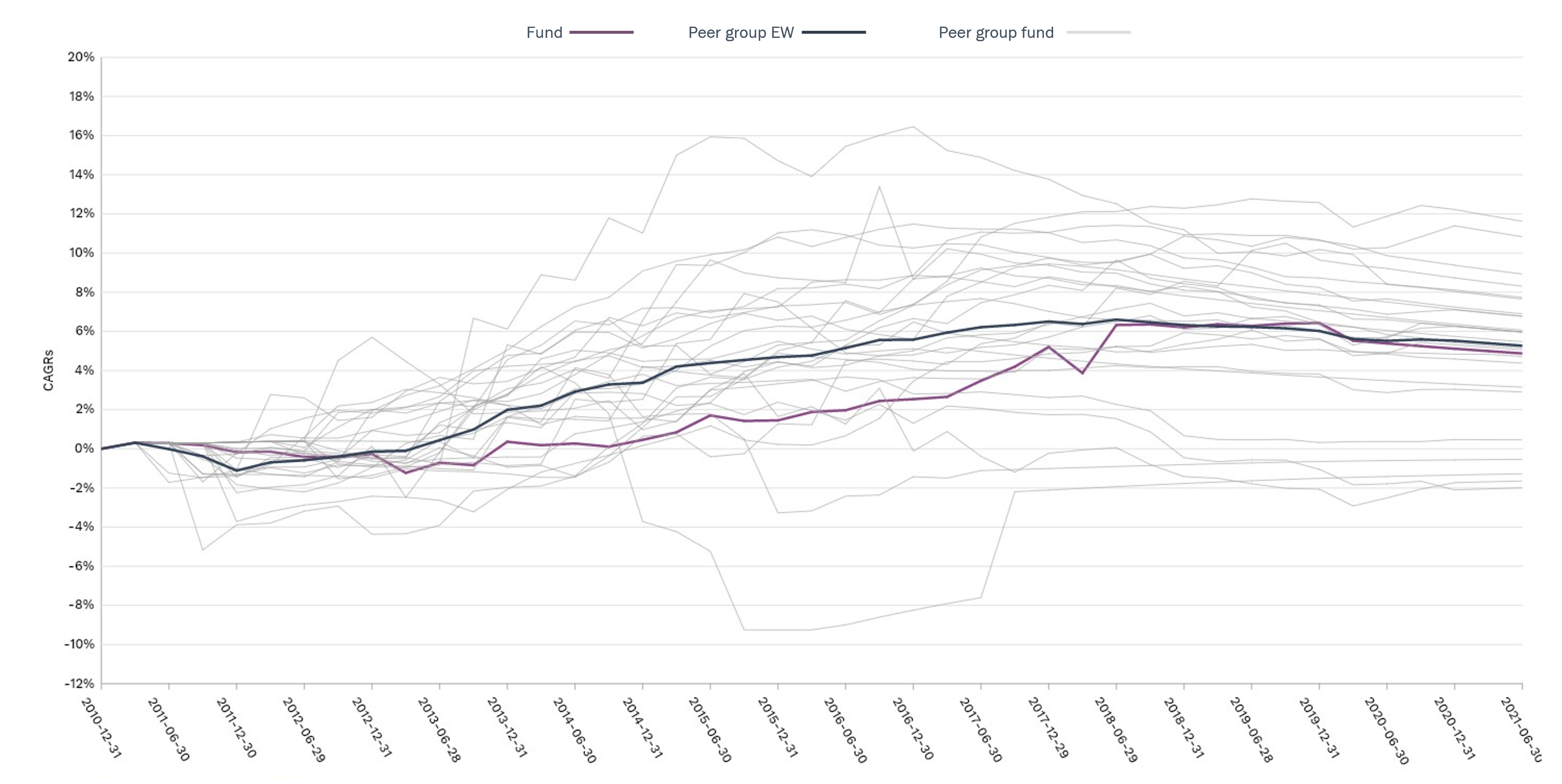

MULTI-PERIOD BENCHMARKING

True Apple-to-Apple Comparability

Restoring the NPV logic with the swap DARC - the marginal rate of financing of private funds over coherent time horizons.

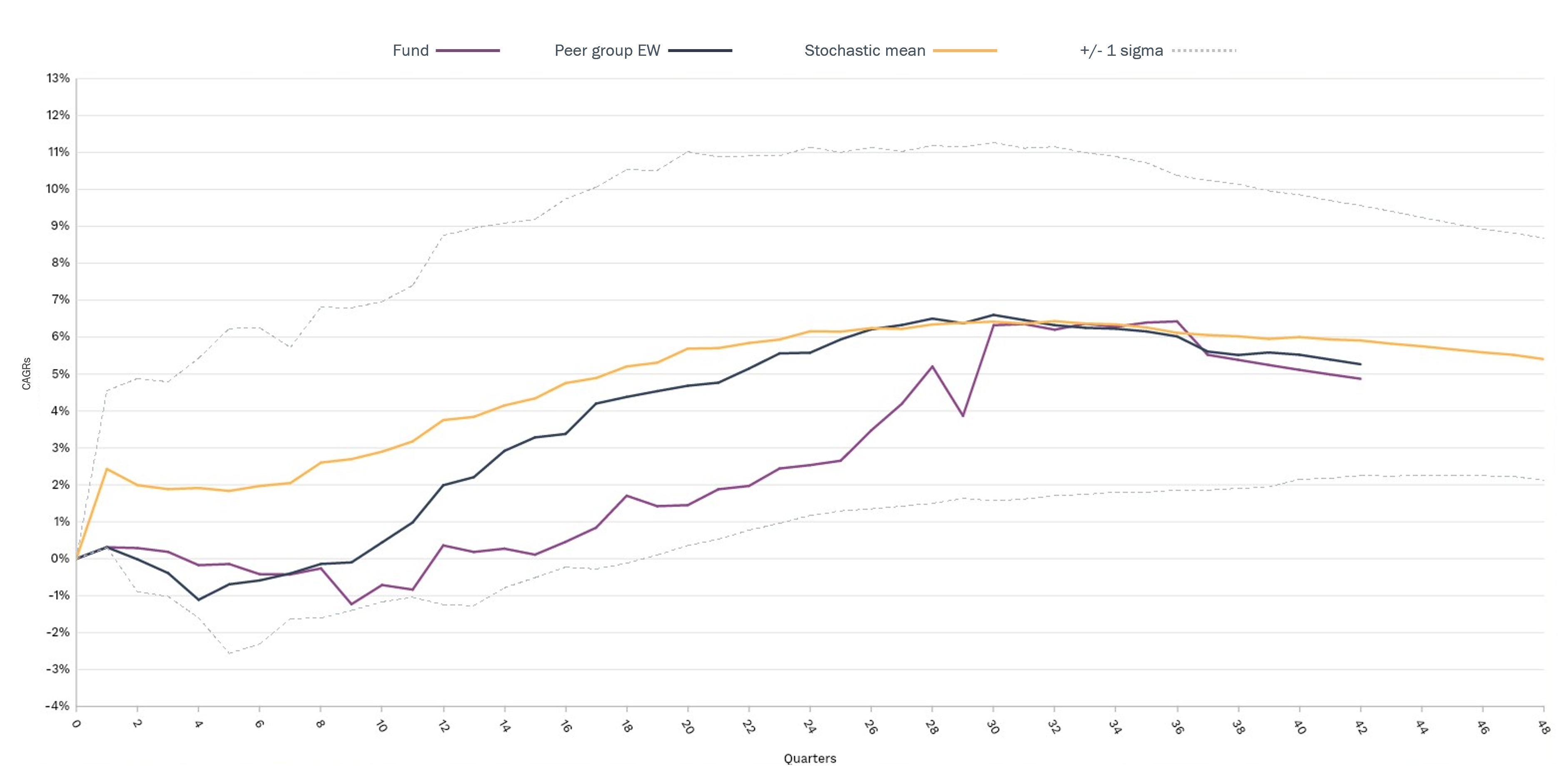

STOCHASTIC ADVANTAGE

Actionable Cross-Vintage Statistics

The DARC creates a robust probabilistic framework for forward-looking forecasting.

REAL-TIME RISK METRICS

Gauged NAV Marks

Measuring the difference between accounting and economic beta in nowcasted terms.

IMPACT

Enhancing active portfolio management possibilities.

Leverage the insight from unique risk and valuation analytics for private equity portfolios.

Take advantage of the firm distinctive know-how and custom projects to increase the efficiency of your private equity program.

Discover what a difference time-weighted analytics make.