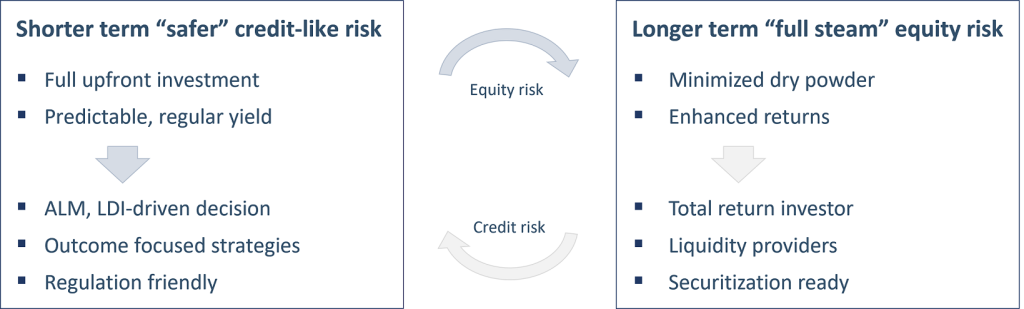

By introducing an innovative performance valuation technology, XTAL is allowing investors to exploit new pricing information and trading possibilities that make “illiquid” private funds as transparent, efficiently accessible and exchangeable as if they were bonds. Private market funds are difficult to price and trade. Blind pools, J-curve, leverage, limited information, long term horizons, contractual constraints, cash flow uncertainty, non-verifiable NAV valuations hinder comparability and-fungibility. ‘Once you get beyond a certain level of investor, (…) that’s a challenge when assets don’t offer daily liquidity or pricing.’ Illiquidity, however, impacts both institutional and individual investors. No possibility of rebalancing or reinvestment causes inefficient portfolio management and dilutes returns. Like commodities, for every vintage, private market funds harvest future cashflow uncertainty. With commodities, the non-fungible risk of future delivery, with respect to uncertain time and quality, is traded against index prices. A similar approach is used with corporate bonds, traded against index prices. XTAL is using proprietary IP to uncover private market fund expected prices. The statistical proxy of an expected price is an average, a benchmark index. Properly constructed indices require time-weighted returns, the missing link in the private market fund industry. Leveraging unique comparability, duration and time-weighting attributes, XTAL is shaping the forward curve, or term structure, of private market yields, and enabling the use of derivatives to rebalance or hedge private market allocations without moving the assets from investors’ portfolios, like with commodities Splitting private market credit and equity risk incentivizes and attracts a broader group of investors (arbitrageurs, hedgers, traders, etc.), leading to a bigger pool of available liquidity. Proprietary technology, investment and capital markets expertise to shape a more efficient marketplace for private markets' investors. Engagement and knowledge sharing to grow reputation, trust and lasting relations. Follow us for private market valuation, trading and risk insights. XTAL has partnered on exclusive terms Exchange Data International Ltd. for the data management of private fund data for regulated indices. The Benchmark Regulation will require any EU-regulated financial intermediary (and anyone doing business with them) to use regulated benchmarks by 2022. How the DARC methodology applies fixed income valuation techniques to private equity to solve its performance puzzle.MISSION AND VISION

Delivering Investors the First Marketplace for Efficient Dynamic Allocation to Private Market Funds

XTAL

/ˈɛkstal/

Acronym: eXchange Traded ALternatives

Abbreviation: short for crystal, standing for transparency

OBJECTIVE

Enabling the Trading of Intelligible Expected Prices

Commoditization

RISK TRANSFER

A Broader Notion of Private Market Liquidity

Derivatives

SIGNALS

XTAL Partners with EDI

LAUNCHING A REGULATED PRIVATE MARKET BENCHMARK INITIATIVE

XTAL Launches a Regulated Benchmarks Awareness Initiative

STARTING A GLOBAL GPs OUTREACH INITIATIVE IN PARTNERSHIP WITH EDI

XTAL Publishes White Paper

RESETTING THE CLOCK ON PRIVATE EQUITY PERFORMANCE